Repair financing options offer a financial safety net for vehicle owners, enabling them to access essential yet costly auto repairs without straining their budget. These cater to various scenarios, from routine maintenance to unexpected incidents. With flexible repayment terms and competitive interest rates, repair financing encourages timely repairs. Personal loans, though appealing due to low-interest rates and fixed monthly payments, pose a risk of property loss if payments are missed. Specialized repair financing may offer more competitive rates and better suited limits for specific projects. Key factors to consider include interest rates, terms, and approval processes, with repair financing offering more flexibility and lower rates for substantial auto body services costs, while personal loans have fixed rates and predictable monthly payments based on financial health.

When unexpected home repairs arise, understanding your financing options is crucial. This article delves into two primary avenues: repair financing options and personal loans. We explore the benefits and suitable scenarios for each, highlighting key advantages and potential drawbacks. By comparing these options, homeowners can make informed decisions tailored to their unique needs and financial situations, ensuring effective and efficient repairs without added stress.

- Understanding Repair Financing Options: Benefits and Suitable Scenarios

- Personal Loans for Home Repairs: Advantages and Potential Drawbacks

- Key Factors to Compare Repair Financing Options vs. Personal Loans

Understanding Repair Financing Options: Benefits and Suitable Scenarios

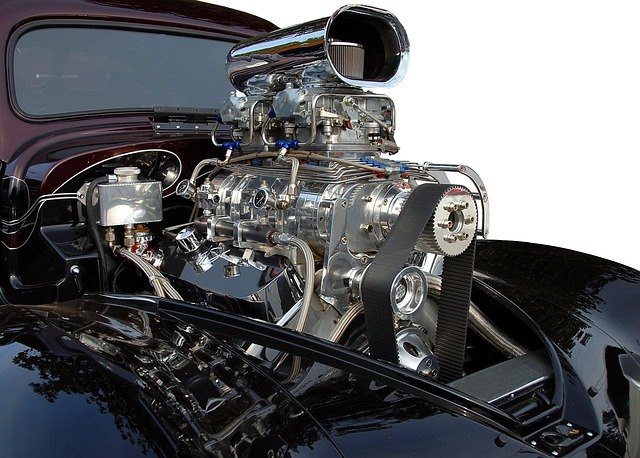

Repair financing options are designed to make essential repairs to vehicles more affordable and accessible for vehicle owners. These options offer several benefits tailored to specific scenarios. For instance, if you need extensive auto body restoration after a collision or accident, repair financing can cover the costs of parts replacement and skilled labor without breaking your budget. This is particularly useful for those who might not have substantial savings dedicated to automotive repairs.

Suitable scenarios include routine maintenance, such as painting services at a body shop, or unexpected incidents like fender benders. Repair financing options often come with flexible repayment terms, allowing vehicle owners to spread the cost over several months. This accessibility encourages individuals to promptly address repair needs rather than delaying them due to financial constraints. Moreover, these financing options may have lower interest rates compared to traditional personal loans, making them an attractive choice for anyone seeking body shop services to restore their vehicle’s condition.

Personal Loans for Home Repairs: Advantages and Potential Drawbacks

When it comes to financing home repairs, personal loans can be a popular choice for many homeowners. The advantages are clear: they offer relatively low-interest rates and fixed monthly payments, making them an attractive option for those looking to budget effectively. Personal loans for home repairs provide flexibility in terms of borrowing amounts and can often be accessed quickly, allowing homeowners to get their projects off the ground swiftly.

However, there are potential drawbacks to consider. These loans are secured against your home, which means if you fail to make payments, you risk losing your property. Additionally, personal loans may not always offer the most competitive rates, especially for smaller loan amounts, and can sometimes come with strict borrowing limits. It’s important for homeowners considering this option to weigh these factors carefully, especially when comparing them to specialized repair financing options that are designed specifically for home improvement projects, including car repair services, auto detailing, and vehicle body repair.

Key Factors to Compare Repair Financing Options vs. Personal Loans

When considering repair financing options versus personal loans for your next car body restoration or visit to a collision repair shop, several key factors come into play. Firstly, interest rates and terms should be your primary concern. Personal loans often have fixed rates and predictable monthly payments, making them attractive for many. However, repair financing plans may offer more flexible terms and lower rates, especially if you’re dealing with substantial auto body services costs.

Additionally, the approval process differs between these two options. Repair financing is typically tied to the cost of repairs, meaning your credit score might not be as critical. Personal loans, on the other hand, are evaluated based on your overall financial health and credit history. This means if you have less-than-perfect credit, personal loans might prove more challenging to secure, while repair financing could still be accessible depending on the extent of the auto body services needed.

When deciding between repair financing options and personal loans, it’s clear that each has its merits. Repair financing options offer benefits like low-interest rates and flexible repayment terms tailored to specific home improvement projects. Personal loans, on the other hand, provide a broader borrowing power with faster approval times. The best choice depends on individual financial situations and project needs. By comparing key factors like interest rates, loan amounts, and repayment periods, homeowners can make an informed decision that aligns with their budget and project requirements.